When it comes to real estate tax deductions, ignorance is not bliss. It can be costly.

The little bit of work that’s required to look up the deductions you qualify for is almost nothing compared to the significant payoff it can yield. The cost-benefit analysis here is a no-brainer.

But it’s usually not the work that prevents agents from saving money each year. More often, it’s a lack of awareness. Agents simply don’t know the many ways they can reduce the amount they owe to the IRS.

So here’s a checklist (with real estate agent tax tips!) so you can ensure you’re being smart with your money and paying no more than you should by taking advantage of all the deductions to which you’re legally entitled.

Start By Tracking All Your Expenses

Why?

Because believe it or not, tracking all your expenses (not just the ones you can write off) is an important prerequisite to maximizing your gross commission income.

How can that be true?

Because your total number of expenditures tells you how much income you need to generate for the year to make ends meet. And without that figure, it’s very difficult to establish the other checkpoints: your new prospects, lead generation, and transaction goals for the day, month, and year. These are the foundations of every growth-oriented real estate business plan.

Granted, documentation can be onerous. But it plays an important role as far as business growth is concerned.

If you have the right expense-tracking system in place, you’ll get more of your hard-earned income back at the end of the year. (Plus, your accountant will love you.)

Take the Efficient Route. Use an App.

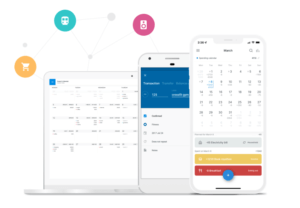

The most efficient way to track your expenses is by using a mobile app. There are numerous free and low-cost options that allow you to categorize and track your expenses on the go.

Our top two picks are user-friendly and available for both iOS and Android devices.

Why You’ll Love It: It’s visually appealing, intuitive, and makes expense-tracking much more pleasant than clicking through a bunch of complicated spreadsheets.

Pricing: The “Basic” plan is free. If you’re looking to level-up, you can go with either the “Plus” plan ($14.99/year) or the “Premium” plan ($22.99/year).

Why You’ll Love It: It’s sleek, simple and calendar-based, which provides agents with the much-appreciated assistance they need to plan and forecast their income and expenses.

Pricing: The “Pro” plan is $4.99/month (or $39.99/year). The “Pro Unlimited” plan is $6.99/month (or $59.99/year).

Download the 8-part Real Estate Business Plan for free.

The Real Estate Tax Deductions Checklist for Agents

Don’t miss out on ways you can maximize your income this year. Make sure you’re accounting for all of the real estate agent tax deductions on this list.

✅ Marketing and Lead Generation

According to the IRS’s “Publication 535,” “Business expenses are the costs of carrying on a trade or business, and they are usually deductible if the business is operated to make a profit.” To qualify as deductible, these expenses must be “ordinary and necessary.”

As all real estate agents would agree, marketing and lead generation certainly meet all of those criteria.

So as you’re noting all of your potential real estate tax deductions for the year, be sure to consider…

- Your marketing costs (e.g., real estate marketing automation tools, print or online ads, photography, flyers, and signage)

- And any expenses related to real estate lead generation

✅ Licenses & Dues

You may also be eligible to deduct the various ongoing operational expenses that allow you to do what you do as a licensed real estate agent. For example:

- Desk fees

- MLS dues

- NAR and other membership fees

- Association dues

- Brokerage fees

✅ Auto Expenses

There are two ways to track your auto expenses.

Method 1: Track the Following…

- mileage (related to business purposes)

- oil changes

- car washes

- gas

- repairs

- any other vehicle-related purchases/expenses

Method 2: Go By the Standard Mileage Rate

With this method, you don’t have to track all your auto-related expenses. Just your mileage.

The IRS sets three federal mileage rates for tax deductions each year. To give you a rough idea, it’s approximately $0.60 per business-related mile. You can check out this IRS mileage guide to learn all of the details, including the current rate.

As for buying a new car…

According to the IRS, “If you use your car only for business purposes, you may deduct its entire cost of ownership and operation.” But if you use it for personal purposes too, you can only deduct the business-related expenses.

You may get more bang for your buck if you lease a car, according to New Jersey CPA Gail Rosen. “Especially the more expensive it is and the more you use it for business,” she says. Apparently, it’s worth it for her: “It saves me more money.”

But it really depends on the situation. Sometimes it makes more financial sense to buy instead of lease.

Certain restrictions apply to leasing luxury vehicles. And leases typically have a 10,000 to 12,000 mile limit. (Above that, you have to pay around $0.25 per mile).

✅ Your Home Office

Whether you own a home or rent, real estate tax deductions related to your home office can be sizeable. So if you’re an independent, self-employed agent and you work from home at least some of the time, be sure to account for the following:

- homeowner’s (or renter’s) insurance

- a portion of your utilities

- expenses related to the home office (such as office supplies) OR a portion of your rent or mortgage based on the square footage of your workspace (assuming it’s dedicated solely to work)

Real estate agents who work both from their home and from their broker’s office may still qualify for the home office deduction, as long as they meet “the principal place of business test.”

To determine if you pass that test, the IRS will look at the importance of the activities that you perform at both places and the amount of time you spend in each location. Administrative and management activities are what the IRS considers “significant” enough to qualify you for the deduction, including:

- Using any tools and business-related software, including your real estate CRM

- Performing bookkeeping and recordkeeping

- Paying bills connected to your business

- Setting appointments (cold calling, for example!)

- Reviewing real estate-related literature and continuing your education as an agent

As long as these activities are performed routinely at home (and not your broker’s office), they may qualify as tax deductions.

✅ Your Kids Who Work For You

Anything that you would normally hire someone else to do is considered a job by the IRS. And it’s perfectly legal to hire your kids to do it. Even better, it might be considered to be a tax deduction for real estate agents.

“By paying their children reasonable wages to do legitimate work, business owners can convert their high-taxed income into tax-free or low-taxed income,” says Peter Jason Riley of Riley & Associates in Newburyport, MA.

But heads up… this can get a little complicated.

- You’ll need to obtain an Employer Identification Number from the IRS so you can have the legal status of an employer.

- There are limits to the kinds of jobs your children can perform. And be mindful of the Fair Labor Standards Act.

- The amount you pay your child needs to be reasonable, according to the work they perform.

- Some states offer stricter guidelines than others.

The bottom line is: Filing real estate agent taxes can be extremely complex. Check with an attorney or with your state’s department of labor for details. Don’t try to figure it out on your own.

✅ Freelancers & Contractors

Many agents outsource some of their business tasks to freelancers and contractors, such as writers, marketing professionals, photographers, graphic artists, and web designers. The fees you pay these professionals are tax deductible.

Keep in mind: you are legally required to report their earnings to the IRS (if they total $600 or more). If you don’t, you may incur penalties.

To report what you pay out, file a 1099. (Copy A goes to the IRS.) That way, not only will you have fulfilled your legal obligation, but you’ll also have proof of these expenses for your accountant.

✅ Gifts for Clients

Giving closing gifts can be a great way to create and nurture strong, long-lasting relationships with your clients. And as an added perk, they may also be tax deductible.

“If you give gifts in the course of your trade or business,” says the IRS’s “Publication 463,” “you may be able to deduct all or part of the cost.”

But keep in mind, it’s limited to $25 per person. So you may not want to shop for anything too extravagant if you want it to make it onto your real estate tax deductions list.

Real Estate Agent Tax Tips

Now that you’ve got your expenses tracked and organized, let’s delve into some savvy tax strategies specifically tailored for real estate agents. Here’s a rundown of key tips to ensure you’re not leaving money on the table come tax season.

Consider Forming an “S Corp”

An S Corporation is a tax designation that provides a way for small businesses to avoid the double taxation that can occur with traditional C Corporations. Instead of the corporation paying taxes on its income and then shareholders paying taxes on their dividends, an S Corp passes income, losses, deductions, and credits through to shareholders for federal tax purposes. Learn more.

Take Advantage of the “PATH Act”

The PATH Act, or Protecting Americans from Tax Hikes Act, was signed into law in December 2015. It’s a piece of legislation that made several significant changes to tax law, with the primary aim of preventing tax fraud and providing tax relief for certain individuals and businesses.

Here are just some of the potential benefits:

Permanent extension of some tax credits

Enhancement of section 179 expensing (which allows businesses to deduct the cost of certain property as an expense rather than depreciating it over time)

R&D tax credit was made permanent and can now be used to offset the alternative minimum tax

Save for Retirement

Don’t underestimate the power of saving for retirement. Contributing to a retirement plan not only secures your financial future but can also result in immediate tax benefits. Explore options like a Simplified Employee Pension (SEP) IRA or a Solo 401(k) to maximize your retirement savings and potential tax deductions. Learn how to reduce your taxes by saving for retirement.

File a 1099 for Any Contractors You Worked With

Given the collaborative nature of the real estate industry, you likely engage freelancers and contractors for various services. Whether it’s writers, marketing professionals, photographers, graphic artists, or web designers, the fees you pay these professionals are tax-deductible.

Make sure to file a 1099 for any freelancer or contractor you pay $600 or more in a tax year. This not only fulfills your legal obligation but also provides necessary documentation for your accountant. Failure to report their earnings may lead to penalties, so staying compliant is crucial.

When it comes to engaging external talent, a diligent approach to reporting and documentation ensures smooth sailing during tax season.

Seek Help From a Professional

Taxes can be a labyrinth of rules, deductions, and potential pitfalls. As you navigate the intricacies of tax season and all of the above real estate agent tax tips, consider enlisting the expertise of a professional tax advisor or accountant.

Here’s why:

- Tax Laws Can Be Extremely Complex

Tax laws, especially those related to real estate, can be intricate and subject to frequent changes. A tax professional stays abreast of these changes and ensures that you are taking advantage of the latest deductions and credits available to real estate agents. - They Can Help You Maximize Deductions

A tax advisor can help you identify deductions you might overlook on your own. From nuanced expenses to industry-specific tax breaks, their knowledge can uncover opportunities to reduce your taxable income. - You Might Need Help Navigating the Legal Stuff

If you’re considering forming an S Corporation or exploring other legal structures, a tax professional can guide you through the process. They’ll help you understand the implications for your specific situation, potentially saving you money in the long run. - They’ll Help You Avoid Costly Mistakes

Mistakes on your tax return can be costly. A tax professional minimizes the risk of errors, providing peace of mind that your filings are accurate and in compliance with the law. - You’ll Be Better Equipped to Plan Strategically

Beyond tax season, a tax advisor can assist with strategic financial planning in general. They can help you structure your business in a tax-efficient manner and plan for long-term financial success. - It’s a Great Networking Opportunity

Like real estate agents, tax advisors and certified public accountants (CPAs) often have a large network. Their client profiles are very similar to those of your target market. And chances are, the topic of real estate – buying, selling, or investing – is a regular part of their day-to-day conversations.

The idea here is to make it so that you’re the name that gets dropped whenever those conversations happen. They’re in a prime position to give high-quality referrals.

Disclaimer: The real estate agent tax tips here are for general informational purposes only. Tax strategies are highly dependent on individual circumstances. We recommend that you seek the services of a qualified and licensed tax professional for advice about your specific situation.

Get Your 2025 Real Estate Business Plan Today!

Planning is the first step in getting more leads and increasing your commission income. Download the free 2025 business planning guide today where you’ll get the full version of what was covered above and much more:

Planning is the first step in getting more leads and increasing your commission income. Download the free 2025 business planning guide today where you’ll get the full version of what was covered above and much more:

- Step-by-step guide to crafting a business plan

- Simple worksheets & brainstorming prompts

- Excel & Google Sheet templates for tracking expenses

- Progress tracker for monitoring goal achievement

- Tips for ensuring your business will thrive in 2025

- Business-planning advice from experienced agents

Submit your email address below to have the “2025 Real Estate Business Plan” sent to your inbox!

800.978.5174

800.978.5174

I appreciate the info you have provided in this article.Specially the info about Documentation and Auto Expenses. I am a Real Estate Agent and will surely make a note your points.

😆

I have been licensed as a Real estate agent/broker in Washington since 1979. Over the years I have purchased land and houses and done some land development, paid the taxes and consider these purchases my inventory. I intended to sell off over time to supplement retirement. I am 82 and cannot afford to retire as the real estate taxes doubled here from 2007 to 2012. Between the R E taxes and the insurances we pay (that includes long-term care as we do not want to burden anyone if we can not care for ourselves. The rentals pretty well cover the expenses and leave enough to build a maintenance fund. We only owe about $9000. on the real estate investments. We deduct the interest on that loan.

We both receive SS and want to know if the medical deductions are taxable?

My husband retired from the Air Force after 23 years and he has a pension that we are most grateful for. He is 85 this year. It seems to me that after paying income tax for sixty years we ought to be excused. The record keeping in addition to the expense is almost unbearable and we can’t afford a bookkeeper. Thank you, Pat

Great tips. I’ve known of many real estate professionals who have had tax & IRS problems.

Will definitely forward to some of my associates.

Hey don’t forget about the home office deduction…it’s easier starting this year. just multiply the square footage of your home office by $5 and that’s your deduction. Limits of up to 300feet.