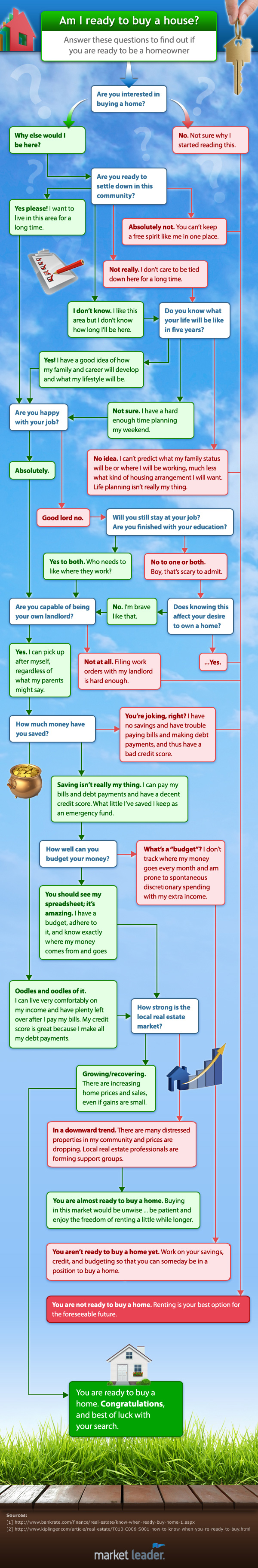

Do you have potential clients who are unsure if homeownership is right for them? Despite the many benefits of owning a home, there are still some people who, for financial or life stage reasons, should hold off on becoming homeowners! Share the below flowchart, “Am I Ready to Buy a House?” on your website or social media accounts to help your leads decide if they’re ready to buy a home.

To further help your potential clients, I’ve listed some important questions and facts below this flowchart that touch on the following topics:

- Questions aspiring homeowners must ask themselves. (These are more detailed versions of the questions asked in the flowchart.)

- The benefits of homeownership – why buying is better than renting.

- Compromises to refrain from making when buying a home.

Feel free to share these points with your potential clients as well!

7 Questions for Aspiring Homeowners

All aspiring homeowners should ask themselves these seven questions before beginning the home-buying process.

“Are You Ready to Settle Down in This Community?”

Here are some questions you should ask yourself about the community you’re considering:

- Will traffic levels and transportation options in this community make for an easy commute?

- Am I comfortable with the crime rate in this community?

- Does this community have the dining, shopping and nightlife options I want?

- Does this community have good schools?

“Do You Know How Your Family and Career Will Develop?”

Before getting serious about buying a home, predict how your family will develop in the coming years. If it is likely that your family may change (e.g., you get married and begin having children), you may want to hold off on buying a home until you can confidently select one large enough.

Careers can alter people’s lives just as family changes can. If a career change is likely, or your career may cause you to move out of state, forgo buying a home until it allows you to be more settled.

“Are You Happy With Your Job?”

Do you hate your job? Are you on the verge of getting laid off? Is your employer having financial troubles that could result in bankruptcy?

If you answered yes to any of the above questions, it would be wise to hold off on becoming a homeowner. Unless you have a trust fund or generous benefactors, you will need a steady stream of income if you want to pay off your mortgage. Make sure you have job security before starting the home-buying process! (While this statement also applies to renters, mortgage payments tend to be considerably higher than rents; if income is required for renting, that statement is doubly true for homeownership.)

“Are You Finished With Your Education?”

Much can be said about the advantages of furthering your education, but if you intend on buying a home anytime soon, going back to school may not be wise. Simultaneously paying for a college education and a new home will eat up all but the largest of incomes – even without taking other expenses into account. So, even if you are able to work and continue your education at the same time, buying a home before ruling out going back to school could result in a considerable strain on your budget!

“Are You Capable of Being Your Own Landlord?”

There are no work orders for homeowners. By signing the closing documents, new homeowners are also signing themselves up for the following responsibilities formerly taken care of by their landlords:

- Servicing appliances like heaters, water heaters, washing machines, etc.

- Making repairs to drywall, windows, doors and plumbing.

- Painting interior and exterior walls.

- Cleaning gutters.

- Maintaining landscaping.

- Exterminating mice, insects and other pests.

If handling maintenance sounds unbearable to you, homeownership may not be your best option.

“How Much Money Have You Saved?”

Significant savings are required for the down payment on a house, which is traditionally 20 percent of its purchase price. It’s also advisable to maintain a healthy bank account balance to pay for emergency repairs and expenses should your income suddenly drop.

“How Strong Is the Local Real Estate Market?”

The U.S. housing market collapse that precipitated the Great Recession taught millions of Americans that market forces can make homeownership a poor decision, even for those who in theory were prepared for it. Regardless of how you answered the above questions, you should hold off on buying a home until you are reasonably confident housing prices will at least remain constant in your area.

Here are some warning signs that housing prices may go belly-up in your desired metro area:

- Major employers are going out of business or are planning on moving their operations.

- Housing prices are rapidly rising, seemingly based on no economic reason.

- There are reports of rising delinquency rates on mortgage loans in your area.

- Housing is rapidly becoming less affordable.

Fortunately, in this post-crash period of rising house prices, it’s likely that your new home will increase in value. In 2013, home prices increased in 88 percent of U.S. cities and rose by double digits in a third of them!

Top 5 Benefits of Homeownership

While purchasing a home isn’t recommended for everyone, it certainly has a ton of advantages over renting. Here are the top five reasons why everyone should strive to become a homeowner:

- Homeownership forces you to save – Instead of thinking of your mortgage as draining your income, view it as a forced savings account. Each mortgage payment increases the amount of equity you have in your home, which, in effect, puts more money in your pocket.

- Homes gain value over time – Making mortgage payments is the opposite of paying rent in the sense that you gain wealth as your home appreciates in value, while paying rent decreases your wealth by draining money that you will never be able to recoup.

- Get tax benefits – The American tax code rewards homeowners by giving them a whole slew of tax write-offs. These include deductions for property taxes, monthly interest paid on mortgages, and mortgage insurance. All told, homeowners can lower their taxable income by more than $10,000 for a $150,000 mortgage!

- Freedom – Homeowners are free to do whatever they want with their property, from making cosmetic changes to completely renovating the entire house. Not having a landlord and a security deposit to worry about can take a load off a homeowner’s mind!

- Stability and fixed housing payments – There is comfort in returning to home sweet home day after day, year after year, not to mention the comfort of knowing exactly how much your monthly housing payment will be for the entire period of your mortgage loan.

Compromises to Never Make When Buying a Home

Here are three compromises all homebuyers should never make:

- Location – This is the one thing that can’t be changed about a house. While flooring, landscaping, and interior decorating can be added or altered, views, proximity to good schools, street noise, and neighborhood safety cannot.

- Thinking with your heart – Keep yourself from falling in love with certain features of a house, as doing so will blind you to any downsides it may have.

- Spending limit – Don’t consider houses priced above the spending limit you set before beginning your home search.

800.978.5174

800.978.5174